Annual Percentage Yield (APY) is accurate as of Feb 27, 2019 and subject to change after the account is opened. Fees may reduce earnings on the account. Aggregate balances over $25 million are subject to negotiated interest rates.

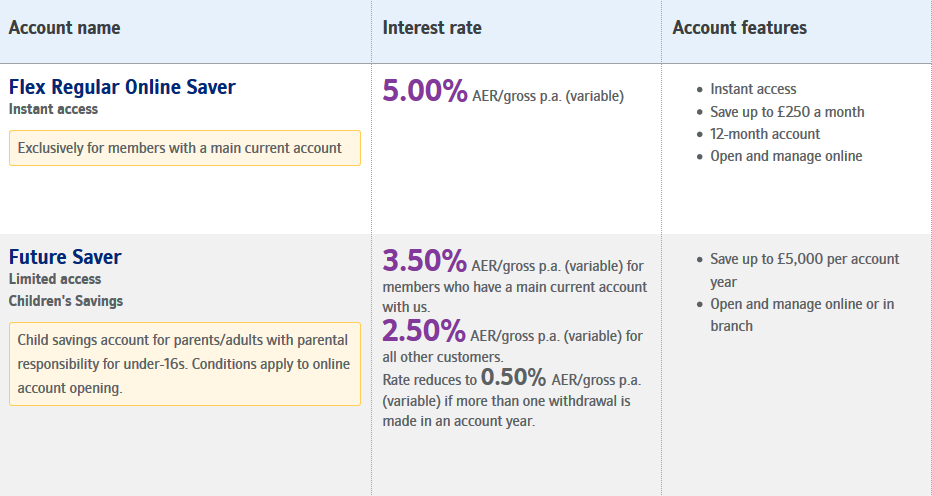

We offer a range of savings accounts including cash ISAs, fixed and variable interest rate savings accounts, business accounts and more. Already have a NorthBridge Finance savings account? Log into the Internet Bank (This link will open in a new window) (This link will open in a new window) to see your current interest rate, or visit our support pages where you can find all our interest rates and other useful information.

What’s your savings goal? Whatever you’re saving towards, our Savings Calculator will help you work out how much you need to save, and how often, to hit your target. This tool gives you an indication of how long it will take to reach your goal. Results are an estimate and should only be used as a rough guide. This tool does not take into account any early access charges or tax that you may have to pay on your interest.

Our Savings Selector is designed to show which of our wide range of accounts might suit you best, based on your answers to the questions below. Please remember the results are just an illustration; it is important to weigh up all the savings options open to you, and to check the details of any account selected, to make sure it will meet your needs.

It can be difficult finding the right account for you, especially when there are so many different types available. We can help you understand what the differences are and help you start saving with confidence.

The type of savings account you choose will depend on your goals. Generally, the longer you’re prepared to lock your money away, the more interest you can get. However, you might suffer a loss of interest if you withdraw from a long-term savings account at short notice and may incur an early access charge, so it’s worth considering how much flexibility you need.

If you need to get your money anytime then these accounts, with unlimited instant access, give you the highest level of flexibility. You can deposit or withdraw your money whenever you need to. This usually means you should expect to receive a lower rate of interest than in limited access accounts or those with fixed terms.

Sometimes it's difficult to know how best to grow your savings. Our impartial savings guides may help you understand your savings options a little more, while our tools, services and support will help make saving easier. Explore the guides and support articles below to get the most out of your NorthBridge Finance savings accounts.